Investing in the Stock Market 101

- Introduction to Investing

- Principles of Investing

- Types of Investments

- How to Read Financial Statements

- Building an Investment Portfolio

- Strategies for Long-Term Investing

- Preparing for Market Uncertainties

How to Read Financial Statements

Understanding Balance Sheets: A Guide for Investors

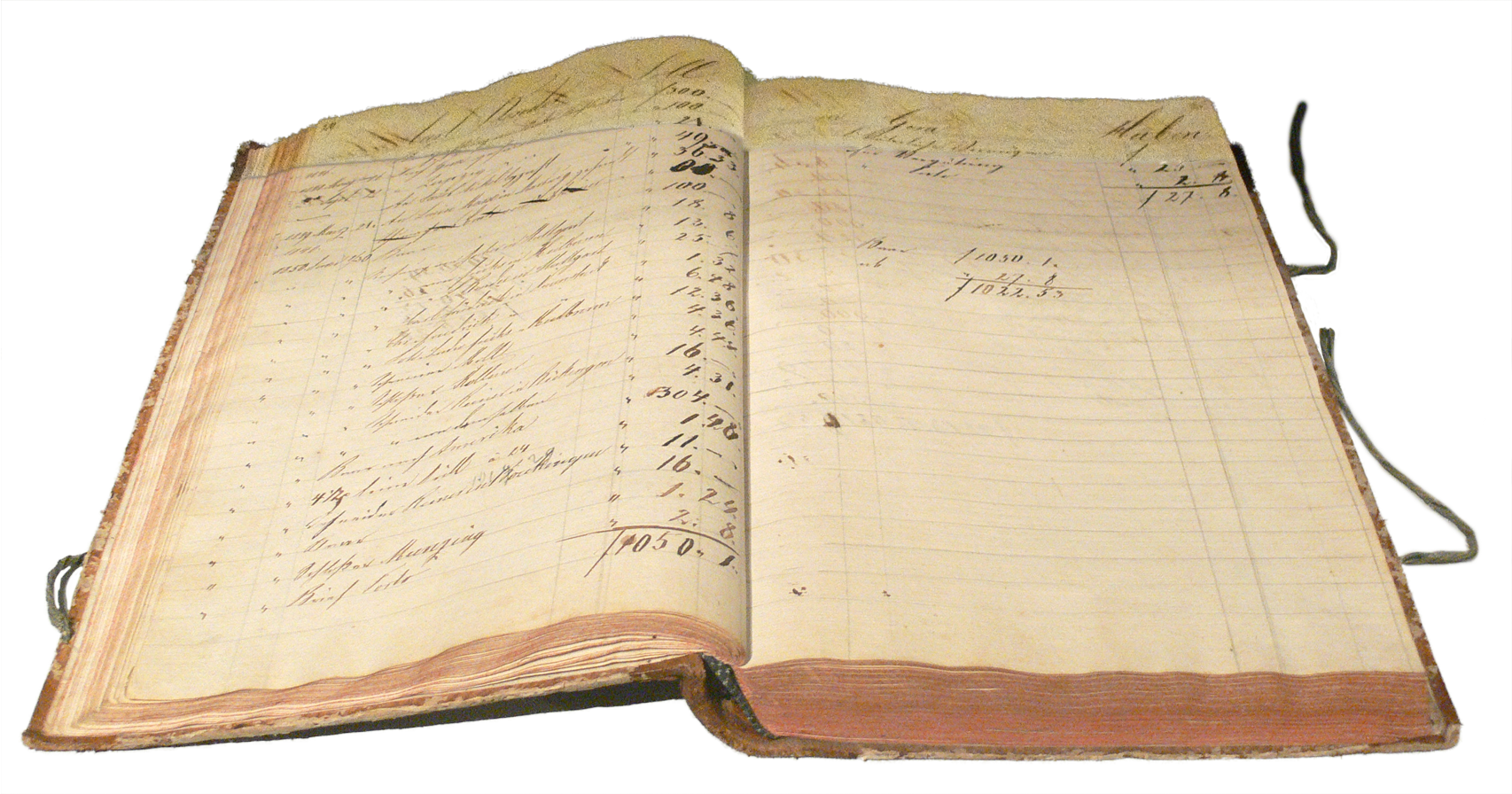

Accounting financial summary.

A balance sheet is one of the most important financial statements for investors. It provides a snapshot of a company's financial health at a specific point in time. The balance sheet is divided into three main sections: assets, liabilities, and shareholders' equity. Understanding these components is crucial for making informed investment decisions.

Structure of a Balance Sheet

A balance sheet is structured around the fundamental equation: Assets = Liabilities + Shareholders' Equity. This equation means that the resources a company owns (assets) are financed by debts (liabilities) and the money shareholders have invested (shareholders' equity).

Assets

Assets are what a company owns and uses to operate its business. They are categorized into two main types:

-

Current Assets: These are assets that can be converted into cash within one year. They include cash and cash equivalents, accounts receivable, inventory, and other short-term assets.

-

Non-Current Assets: These are long-term assets that cannot be easily converted into cash. They include property, plant and equipment (PP&E), intangible assets like patents and trademarks, and long-term investments.

Liabilities

Liabilities are what a company owes to others. Like assets, liabilities are also categorized into two main types:

-

Current Liabilities: These are debts that must be paid within one year. They include accounts payable, accrued liabilities, and short-term debt.

-

Non-Current Liabilities: These are long-term debts that are not due within the next year. They include long-term debt, deferred tax liabilities, and pension obligations.

Shareholders' Equity

Shareholders' equity represents the net assets of a company, i.e., the assets remaining after deducting liabilities. It's what the shareholders own. It includes:

-

Common Stock: This represents the initial capital invested by the shareholders.

-

Retained Earnings: These are the profits that the company has earned over time and chosen to reinvest in the business rather than distribute as dividends.

-

Treasury Stock: These are the shares that the company has repurchased from shareholders. They are deducted from shareholders' equity because they represent a return of capital to shareholders.

The Relationship Between Assets, Liabilities, and Equity

The balance sheet gets its name from the fact that the two sides of the equation (Assets = Liabilities + Shareholders' Equity) must balance out. This means that if a company finances its assets by taking on more liabilities, its shareholders' equity decreases. Conversely, if a company pays off its liabilities, its shareholders' equity increases.

Understanding a balance sheet is crucial for investors because it provides key insights into a company's financial health. By analyzing a company's assets, liabilities, and shareholders' equity, investors can assess the company's liquidity, solvency, and capital structure, which are all important factors in investment decision-making.