Property & Casualty Agent 101

- Introduction to Property and Casualty (P&C) Insurance

- General Liability Insurance

- Workers Compensation Insurance

- Stock Throughput Policies

- Product Recall Coverages

- Inland Marine Insurance

- Cyber Insurance

- Directors and Officers (D&O) Insurance

- Other Insurance Policies

- Other Insurance Policies

- Other Insurance Policies

- Other Insurance Policies

- Wrap Up and Preparation for Licensing Exam

Introduction to Property and Casualty (P&C) Insurance

The History of Property and Casualty Insurance

Equitable transfer of the risk of a loss, from one entity to another in exchange for payment.

Insurance, as a concept, has been around for centuries. It is a means of protection from financial loss and is essentially a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

The origins of insurance can be traced back to ancient civilizations. The Babylonians developed a system which was recorded in the famous Code of Hammurabi, around 1750 BC. This system was practiced by early Mediterranean sailing merchants. If a merchant received a loan to fund his shipment, he would pay the lender an additional sum in exchange for the lender's guarantee to cancel the loan should the shipment be stolen or lost at sea.

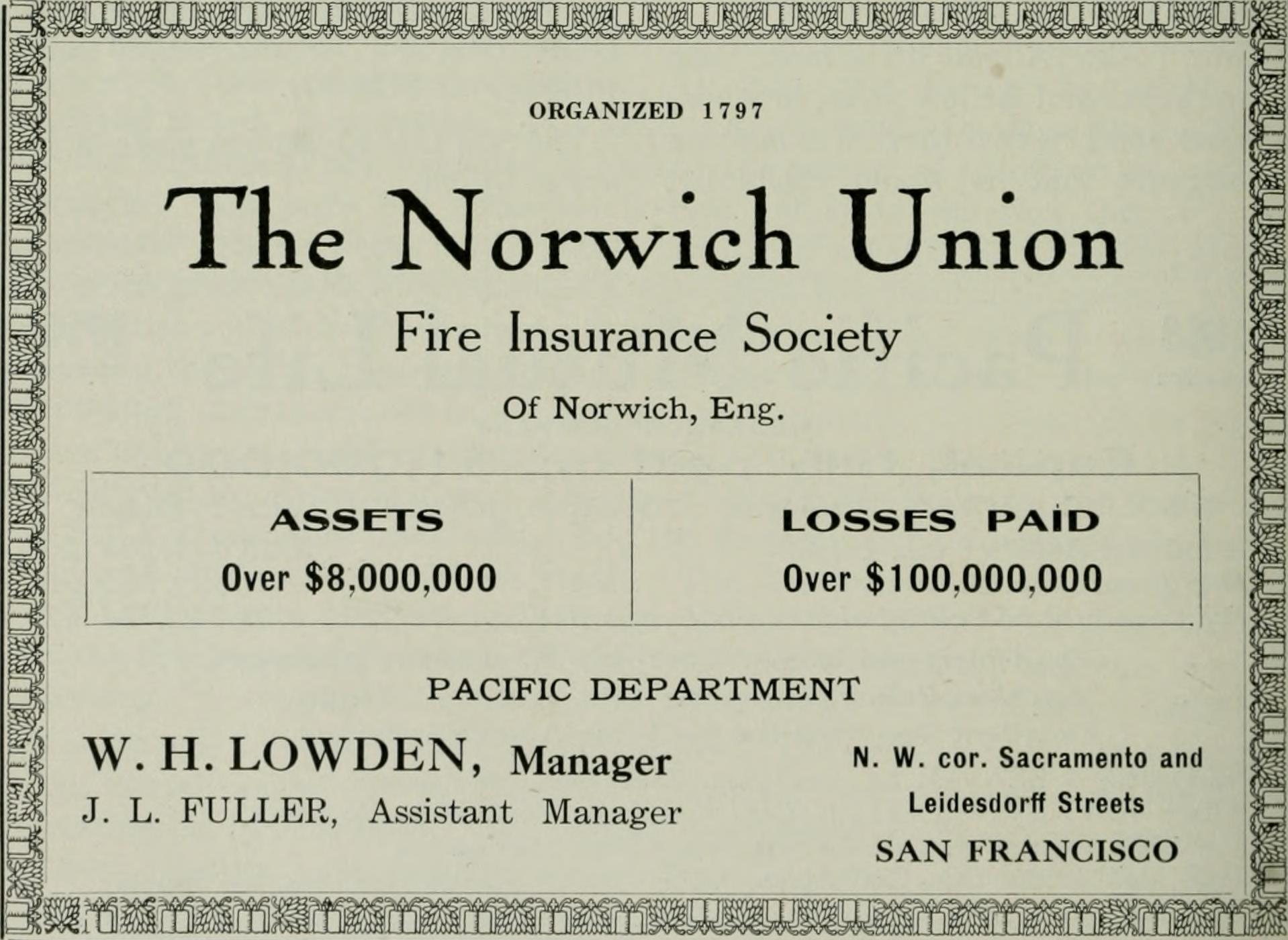

However, the concept of property and casualty (P&C) insurance as we know it today, began to take shape in the late 17th century with the advent of fire insurance following the Great Fire of London in 1666. The first insurance company in the United States underwrote fire insurance and was formed in Charleston, South Carolina, in 1735.

Over time, the P&C insurance industry has evolved and expanded, covering a wide range of risks. The 19th century saw the introduction of casualty insurance, which includes insurance for liability, theft, aviation, workers' compensation, and glass and boiler insurance. The 20th century brought further expansion with the advent of automobile insurance, and the 21st century has seen the introduction of new forms of coverage such as cyber insurance.

Key historical events have also shaped the P&C insurance industry. For instance, the San Francisco earthquake of 1906 led to the bankruptcy of many insurance companies and prompted the industry to exclude certain risks, like those related to natural disasters, from standard policies. Similarly, the terrorist attacks of September 11, 2001, led to the creation of the Terrorism Risk Insurance Act in the United States, which provides a federal backstop for terrorism coverage.

In conclusion, the history of P&C insurance is a testament to the industry's ability to adapt and evolve in response to new risks and societal changes. As we look to the future, it is clear that the P&C insurance industry will continue to play a crucial role in helping individuals and businesses manage risk in an increasingly complex and uncertain world.