Stock Exchanges and Clearing Houses

- Introduction to Stock Exchanges

- Mechanics of Stock Trading

- Basics of Clearing Houses

- Interplay of Stock Exchanges and Clearing Houses

Mechanics of Stock Trading

Understanding Order Types and Trading Strategies in Stock Trading

Buying and selling financial instruments within the same trading day.

In the world of stock trading, understanding order types and trading strategies is crucial. This knowledge allows traders to make informed decisions, manage risk, and potentially increase profits. This article will delve into the different types of stock orders and trading strategies.

Stock Orders

Stock orders are instructions that traders give to brokers to buy or sell stocks. There are several types of orders:

-

Market Orders: This is the most straightforward type of order. A market order instructs a broker to buy or sell a stock immediately at the best available current price.

-

Limit Orders: A limit order instructs a broker to buy or sell a stock at a specific price or better. For a buy limit order, the stock is bought at the limit price or lower. For a sell limit order, the stock is sold at the limit price or higher.

-

Stop Orders (or Stop-Loss Orders): A stop order becomes a market order once a certain price level, known as the stop price, is reached. It's used to limit an investor's loss on a security position.

-

Stop Limit Orders: A stop limit order combines the features of a stop order and a limit order. Once the stop price is reached, the stop limit order becomes a limit order to buy or sell at the limit price or better.

Trading Strategies

Trading strategies are plans that traders use to determine when to buy or sell stocks. They are based on careful analysis and can help traders make profitable decisions. Here are some common trading strategies:

-

Day Trading: This strategy involves buying and selling stocks within the same trading day. Day traders aim to profit from short-term price movements.

-

Swing Trading: Swing traders hold positions for days or weeks, aiming to profit from short-term price patterns or trends.

-

Position Trading: Position traders hold stocks for long periods, often months or years. They typically rely on fundamental analysis and long-term price trends.

-

Algorithmic Trading: This strategy uses computer algorithms to automate trading decisions. It can involve complex strategies like high-frequency trading, where large volumes of stocks are bought and sold within microseconds.

Role of Technical Analysis

Technical analysis plays a crucial role in many trading strategies. It involves analyzing statistical trends gathered from trading activity, such as price movement and volume. Traders use technical analysis to identify patterns that can suggest future activity.

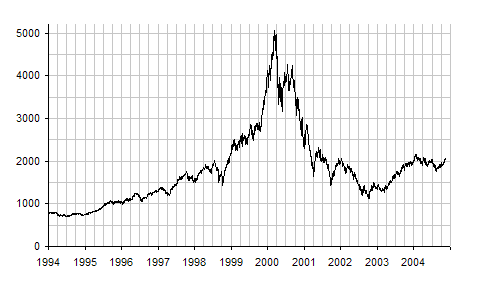

Impact of Market Trends

Market trends can significantly impact trading strategies. For instance, in a bull market, traders might lean towards long positions. In contrast, in a bear market, traders might take short positions or use strategies to protect against falling prices.

In conclusion, understanding order types and trading strategies is a fundamental aspect of stock trading. It allows traders to navigate the market effectively, manage risks, and potentially increase their profits.