Trading for Living

- Introduction to US Index Futures

- Understanding the Indexes

- The S&P 500 Index

- Fundamental Analysis

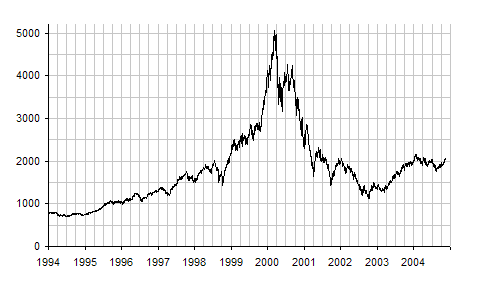

- Technical Analysis

- Medium Term Trading Strategies

- Long Term Investing Strategies

- Trading Psychology

- Money Management Techniques

- Trading Systems and Platform

- Legality and Taxation

- Building a Trading Plan

- Final Project and Course Wrap-up

Medium Term Trading Strategies

Developing Your Own Medium Term Trading Strategy

Buying and selling financial instruments within the same trading day.

Medium-term trading is a popular strategy among traders and investors. It involves holding positions for several weeks to several months. This strategy strikes a balance between the high-speed world of day trading and the long-term, buy-and-hold approach of investing.

Developing a successful medium-term trading strategy requires a clear understanding of your financial goals, risk tolerance, and time commitment. Here are the steps to develop your own medium-term trading strategy:

Understand Your Financial Goals

Before you start trading, it's important to understand your financial goals. Are you trading to supplement your income, save for retirement, or grow your wealth? Your financial goals will guide your trading decisions and help you choose the right trading strategy.

Determine Your Risk Tolerance

Risk tolerance is the amount of money you are willing to risk on each trade. It's important to determine your risk tolerance before you start trading. This will help you manage your risk and avoid costly mistakes. Remember, never risk more than you can afford to lose.

Choose Your Trading Instruments

There are many different trading instruments available, including stocks, futures, options, and forex. Each instrument has its own characteristics and requires a different trading strategy. Choose the trading instruments that best fit your financial goals and risk tolerance.

Develop Your Trading Plan

A trading plan is a written document that outlines your trading strategy. It includes your financial goals, risk tolerance, trading instruments, and trading rules. Your trading plan should also include a system for tracking and analyzing your trades.

Use Technical Analysis

Technical analysis is a method of predicting future price movements based on historical price data. It involves using charts and technical indicators to identify patterns and trends. Technical analysis can be a powerful tool for medium-term trading.

Use Fundamental Analysis

Fundamental analysis is a method of evaluating a security's intrinsic value by examining related economic and financial factors. While it's often associated with long-term investing, fundamental analysis can also be used in medium-term trading to identify undervalued or overvalued securities.

Test Your Trading Strategy

Before you start trading with real money, it's important to test your trading strategy. This can be done through paper trading or using a trading simulator. Testing your trading strategy will help you identify any flaws and make necessary adjustments.

Review and Adjust Your Trading Strategy

Finally, it's important to regularly review and adjust your trading strategy. The financial markets are constantly changing, and a strategy that worked in the past may not work in the future. Regularly reviewing and adjusting your trading strategy will help you stay ahead of the market.

Remember, successful trading is not about making a few big trades. It's about making consistent profits over the long term. Developing a successful medium-term trading strategy requires patience, discipline, and a commitment to continuous learning.