Utah Escrow Officer

- Introduction to Title Insurance

- Understanding Real Estate Contracts

- Title Search and Examination

- Role of the Escrow Officer

- Settlement and Policy Issuance Process

- Legal & Ethical Aspects in Title Insurance

- Compliance with Utah State Regulations

- Escrow Officer Certification Process

Legal & Ethical Aspects in Title Insurance

Ethical Practices in the Title Insurance Industry

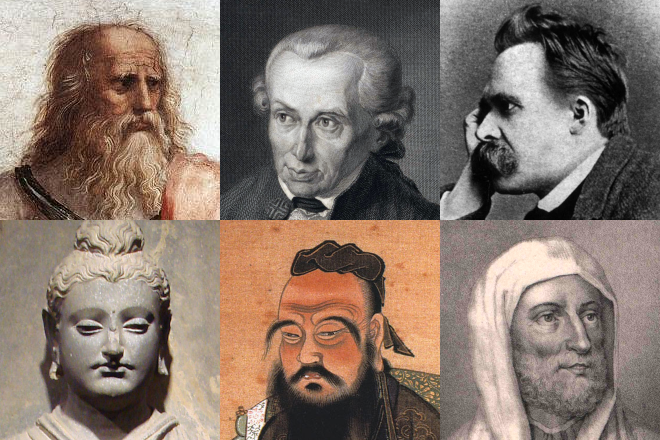

Branch of philosophy that systematizes, defends, and recommends concepts of right and wrong conduct.

Ethics play a crucial role in the title insurance industry. As professionals dealing with significant financial transactions and sensitive information, it is essential for escrow officers to adhere to a high standard of ethical conduct. This article will delve into the importance of ethics in title insurance, common ethical issues, the ethical decision-making process, and real-world case studies.

Importance of Ethics in Title Insurance

Ethics in title insurance is not just about adhering to the law; it's about maintaining trust and credibility with clients and other stakeholders. Ethical practices ensure fairness, transparency, and integrity in all transactions. They also protect clients' rights and interests, contributing to the overall reputation and success of the title insurance industry.

Common Ethical Issues in Title Insurance

Several ethical issues can arise in the title insurance industry. These include conflicts of interest, misuse of client funds, misrepresentation of information, non-disclosure of relevant facts, and violation of privacy rights. For instance, an escrow officer might face a conflict of interest if they have a personal relationship with a party involved in the transaction. Misuse of client funds, on the other hand, involves using escrow funds for purposes other than those specified in the escrow agreement.

Ethical Decision-Making Process in Title Insurance

Making ethical decisions in title insurance involves several steps. First, identify the ethical issue or dilemma. Next, gather all relevant information and evaluate the options. Consider the potential impact of each option on all stakeholders involved. Then, make a decision based on ethical principles and industry standards. Finally, implement the decision and evaluate its outcomes. It's important to document each step of this process for accountability and transparency.

Case Studies on Ethical Dilemmas in Title Insurance

Real-world case studies provide valuable insights into ethical dilemmas in title insurance. For example, a case might involve an escrow officer who discovers a significant error in a title report but is pressured by a client to close the transaction quickly. Another case might involve an escrow officer who is offered a bribe to expedite a transaction. These cases highlight the importance of ethical decision-making and the challenges that escrow officers may face in upholding ethical standards.

In conclusion, ethical practices are integral to the title insurance industry. They ensure the protection of clients' rights and interests, maintain trust and credibility, and contribute to the industry's overall success. As escrow officers, it is our duty to uphold these ethical standards and make decisions that are fair, transparent, and in the best interest of all parties involved.