How to grow your portfolio using Dividend Value investing strategies

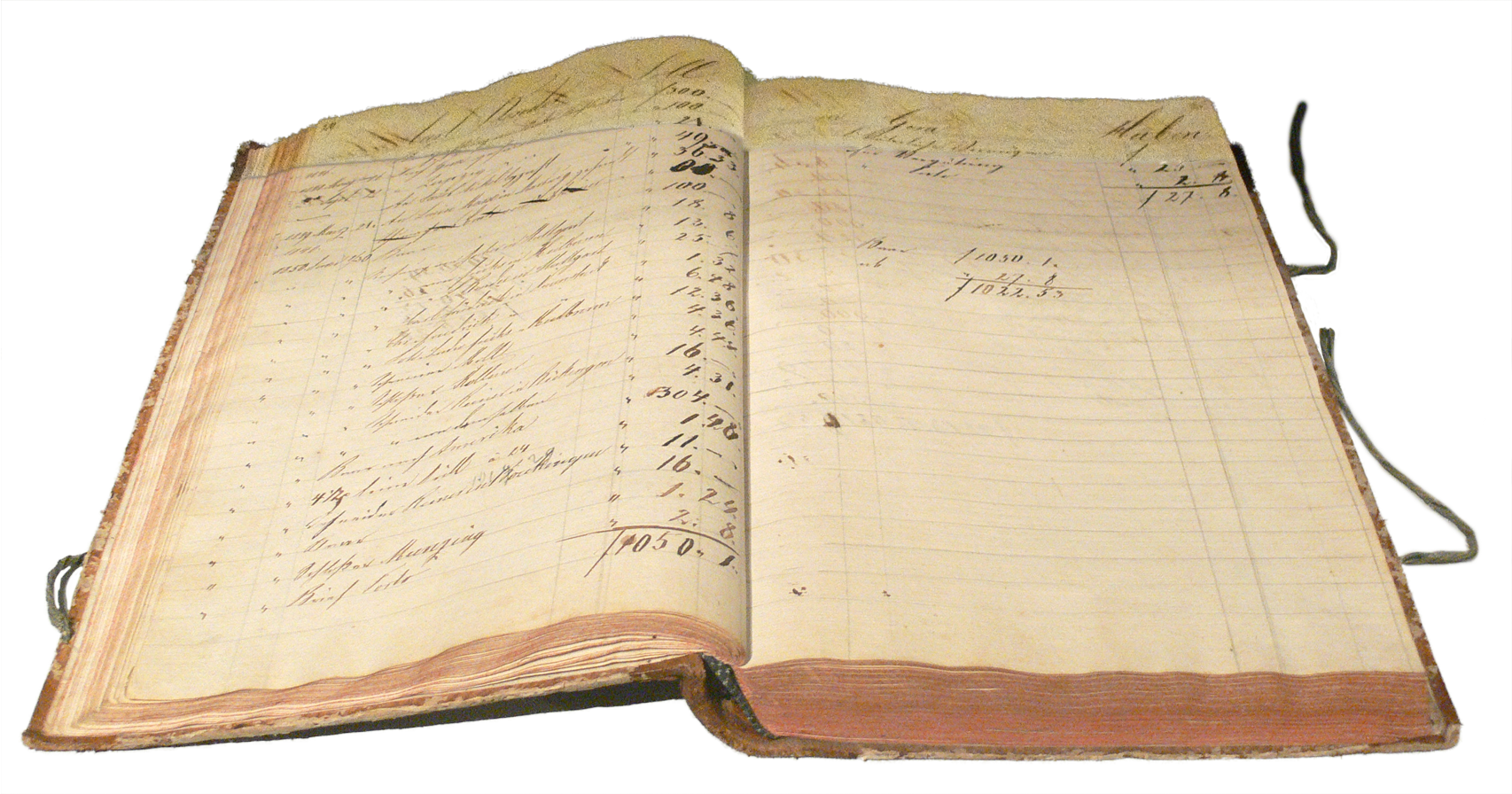

- Introduction to Dividend Investing

- Understanding Dividend Aristocrats

- Comprehensive Overview of Dividend Aristocrats

- Identifying Potential Aristocrats

- Portfolio Creation & Management

- Dividend Reinvestment Plans

- Tax Implications of Dividend Investing

- Advanced Income Strategies

- Market Trends & Dividend Aristocrats

- Recession Proofing Your Portfolio

- International Dividend Aristocrats

- Dividend Investing Case Studies

- Developing a Dividend Investing Plan

Developing a Dividend Investing Plan

Monitoring and Adjusting Your Dividend Investing Plan

Payment made by a corporation to its shareholders to distribute profits.

Investing is not a set-it-and-forget-it activity. It requires regular monitoring and adjustments to ensure that your investment plan continues to align with your financial goals and market conditions. This article will guide you through the process of monitoring and adjusting your dividend investing plan.

Importance of Regular Portfolio Reviews

Regular portfolio reviews are crucial to successful investing. They allow you to assess the performance of your investments and make necessary adjustments. For dividend investors, this could mean checking if the companies in your portfolio are maintaining their dividend payouts or if there are any changes in their financial health that could affect future payouts.

Monitoring the Performance of Dividend Aristocrats

Monitoring the performance of dividend aristocrats in your portfolio involves more than just tracking their stock prices. You should also keep an eye on their dividend yields, payout ratios, and earnings growth. These factors can give you an idea of whether a company is likely to continue paying dividends at the current rate or if it might increase or cut its dividend in the future.

Identifying Signs for Plan Adjustment

Several signs might indicate that you need to adjust your investment plan. These include:

-

Changes in a company's dividend policy: If a company cuts or eliminates its dividend, it's no longer a suitable investment for a dividend-focused portfolio. On the other hand, if a company significantly increases its dividend, it might be worth adding to your portfolio or increasing your existing position.

-

Changes in market conditions: Market conditions can affect the performance of dividend aristocrats. For example, during a recession, some companies might cut their dividends, while others might maintain or even increase their payouts. You need to adjust your portfolio to reflect these changes.

-

Changes in personal financial circumstances or investment goals: If your financial situation or investment goals change, your investment plan should change too. For example, if you're nearing retirement, you might want to shift towards more conservative investments to preserve capital.

Adjusting Your Investment Plan

Adjusting your investment plan involves rebalancing your portfolio to align with your current investment goals and market conditions. This might involve selling stocks that no longer meet your criteria and buying new ones that do. It could also involve adjusting your asset allocation or diversification strategy.

Remember, the goal of adjusting your plan is not to time the market or chase after the highest possible returns. Instead, it's about ensuring that your investment plan continues to serve your financial goals and risk tolerance.

In conclusion, monitoring and adjusting your dividend investing plan is a crucial part of successful investing. By regularly reviewing your portfolio and making necessary adjustments, you can ensure that your investments continue to work towards achieving your financial goals.